Latest News

Oil swung wildly Monday as fears over the Strait of Hormuz collided with signals the US-Iran conflict may soon wind down.

Iran named the son of the late Ayatollah Ali Khamenei as its new supreme leader and President Donald Trump called $100 oil a 'small price to pay'.

'The island has evolved into the backbone of Iran's export system', J.P. Morgan analysts stated.

'These are just incredible moves', Aaron Hill, Chief Market Analyst at FP Markets, said.

WTI jumped 12% Friday as disrupted shipping and supply fears pushed crude toward $100 a barrel.

Rigzone talks to Rebecca Babin, a senior equity trader for CIBC Private Wealth in New York.

Maritime traffic in the Strait of Hormuz has ground to a near-complete halt, with no oil shipments going through in the past 24 hours.

The widening conflict in the Middle East is stoking fears over a global energy crunch.

Analysts at BMI, a Fitch Solutions company, revealed that they expect 'significant yet short lived rallies in oil and gas prices'.

'At a time of huge global uncertainty, the UK should be making decisions for the long term in the interests of energy security', OEUK CEO David Whitehouse said.

Oil prices surged to their highest levels in nearly two years as the Middle East conflict threatens global energy flows.

INTERTANKO and OCIMF have issued a joint statement on the situation in the Middle East.

Saudi Arabia is diverting millions of barrels of oil to its Red Sea ports.

J.P. Morgan analysts highlighted that 'to reopen the Strait, President Trump announced on Tuesday that the U.S. will escort and insure all commercial vessels transiting Hormuz, leveraging the DFC'.

Rigzone talks to Benjamin Zycher, a Senior Fellow at the American Enterprise Institute, and Doug Bandow, a Senior Fellow at the Cato Institute.

The EU does not expect immediate impact from the fresh Middle East conflict on the security of oil and gas supply in the bloc, even amid a stoppage of flows from the Druzhba oil pipeline.

Oil fluctuated as the Iran war disrupts Gulf energy flows and threatens global supply routes.

North America dropped 11 rigs week on week, according to Baker Hughes' latest North America rotary rig count.

Russia's flagship crude blend is still trading at deep discounts despite a global oil rally.

Oil prices rise in both scenarios.

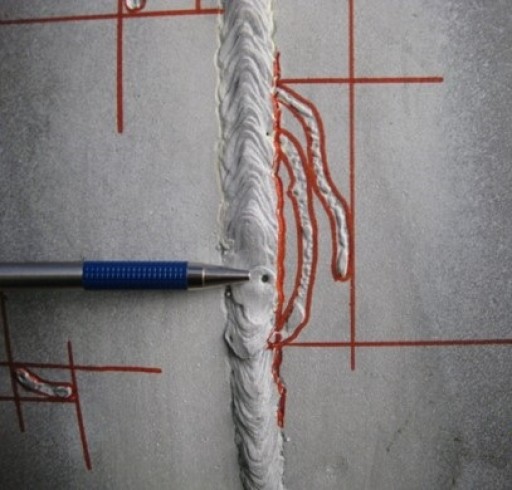

You can choose to embrace it or ignore it. You can choose to pretend it does not apply to you. But the one thing you likely will not be able to do is work as a pipeline inspector without it after 2018. What is it you ask? It is the American Petroleum Institute Pipeline Inspector Certification; better known as the API 1169. Possibly a thorn in the side for many inspectors but for the industry it is a sure step forward in the right direction; joining the other sectors of oil & gas.

Questions surround the API 1169 exam requirements, purpose, and what individuals need to do in order to properly prepare for the certification that will likely keep them employed in their careers. Training options have been multiplying as the popularity of the API 1169 has hit the mainstream. Inspectors should perform their research and due diligence to adequately make an informed choice when it comes to the training course they attend.